If you stopped people on the street and asked someone to name a type of life insurance, you most likely would get these two types of life insurance: term and whole life. They are commonly known, yet there’s also final expense, mortgage protection and several variations of each.

Let’s explore how we use each one and see what type of life insurance fits your family and financial needs.

Just as it sounds, term life insurance is coverage for a specific amount of time, or “term” and can help your family with expenses after you are gone. Term life insurance can help reduce any financial burden on your family if they no longer have your income to rely on

Rather than temporary coverage, you may prefer protection that lasts a lifetime. Unlike term life insurance, whole life insurance stays with you for as long as you pay the premiums and can accumulate cash value. Cash value is accrued from a portion of your monthly premiums and can be used later on in life for big expenses.

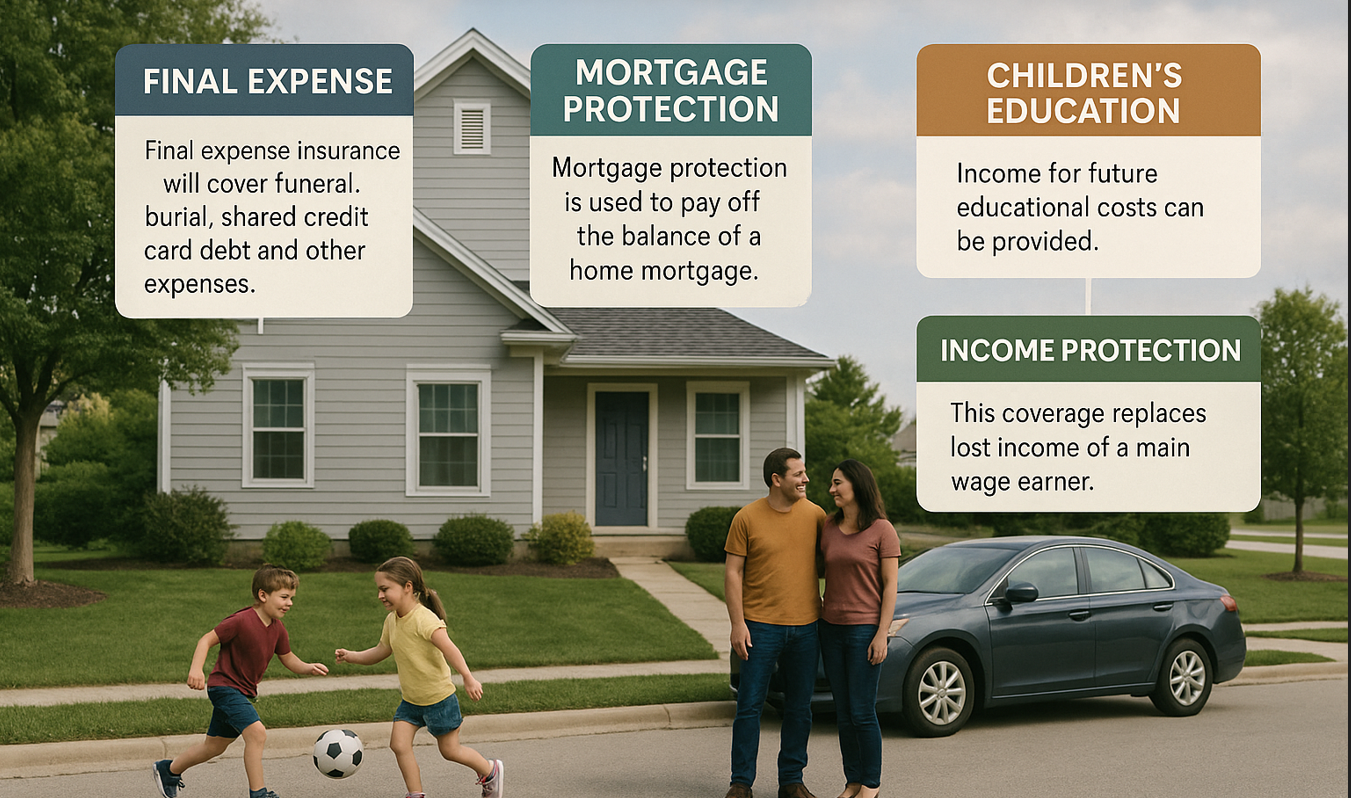

The cost of a funeral can be surprising, leaving your loved ones in a bind after your death. Final expense insurance, or burial insurance, is a one-time payment designed to help your family tie any lose ends after you’ve passed.

Our youth is our future, so everything we do is to help give them a better life. A children’s life insurance policy (also known as juvenile life insurance) gives your children a financial head start, ensures their future insurability, and locks in the lowest rates they’ll ever have.

Accidental death insurance provides an extra layer of coverage to help financially prepare for life’s accidents. We’re exposed to potential accidents every day – accidental death insurance can be a cost-effective choice to help relieve worries and the “what ifs” both on and off the job.

Just as life insurance helps protect your family, mortgage protection insurance helps protect your home. Designed to reduce or payoff your remaining mortgage due to the death of a covered accident, mortgage protection insurance coverage can be a cost-effective choice to help ensure your family remains in the home.